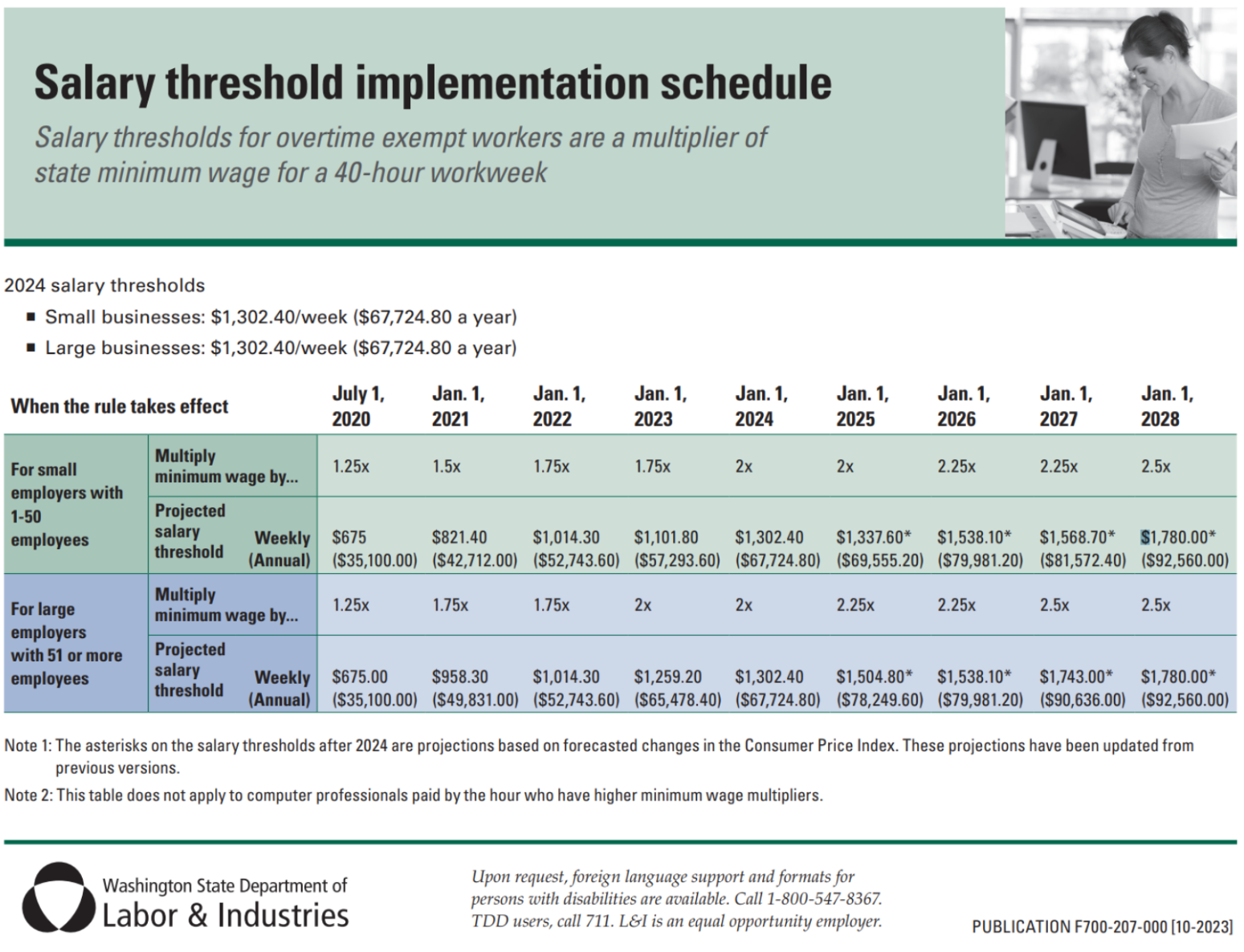

Washington State Exempt Salary Threshold 2024. The overtime salary threshold is adjusted annually by the washington state department of labor & industries (l&i) until the threshold reaches 2.5 times the state. In addition, beginning march 13, 2024, employees in new york state must be paid at least $1,300 per week ($67,600 per year) to be exempt under article 6 of the new.

The current salary threshold for highly compensated (hc) positions is $107,432 per year, with at least $684 paid per week on a salary or fee basis. The washington state department of labor & industries has updated its rules regarding the minimum.

The state of washington has announced increases in the minimum wage rate and the exempt salary thresholds for employees, effective january 1, 2024.

LEGAL UPDATE Washington State to Raise Minimum Wage and Exempt Salary, Tax deducted at source (tds): With the state salary thresholds for exempt employees now a multiplier of the state minimum wage, one of the thresholds multipliers will rise on jan.

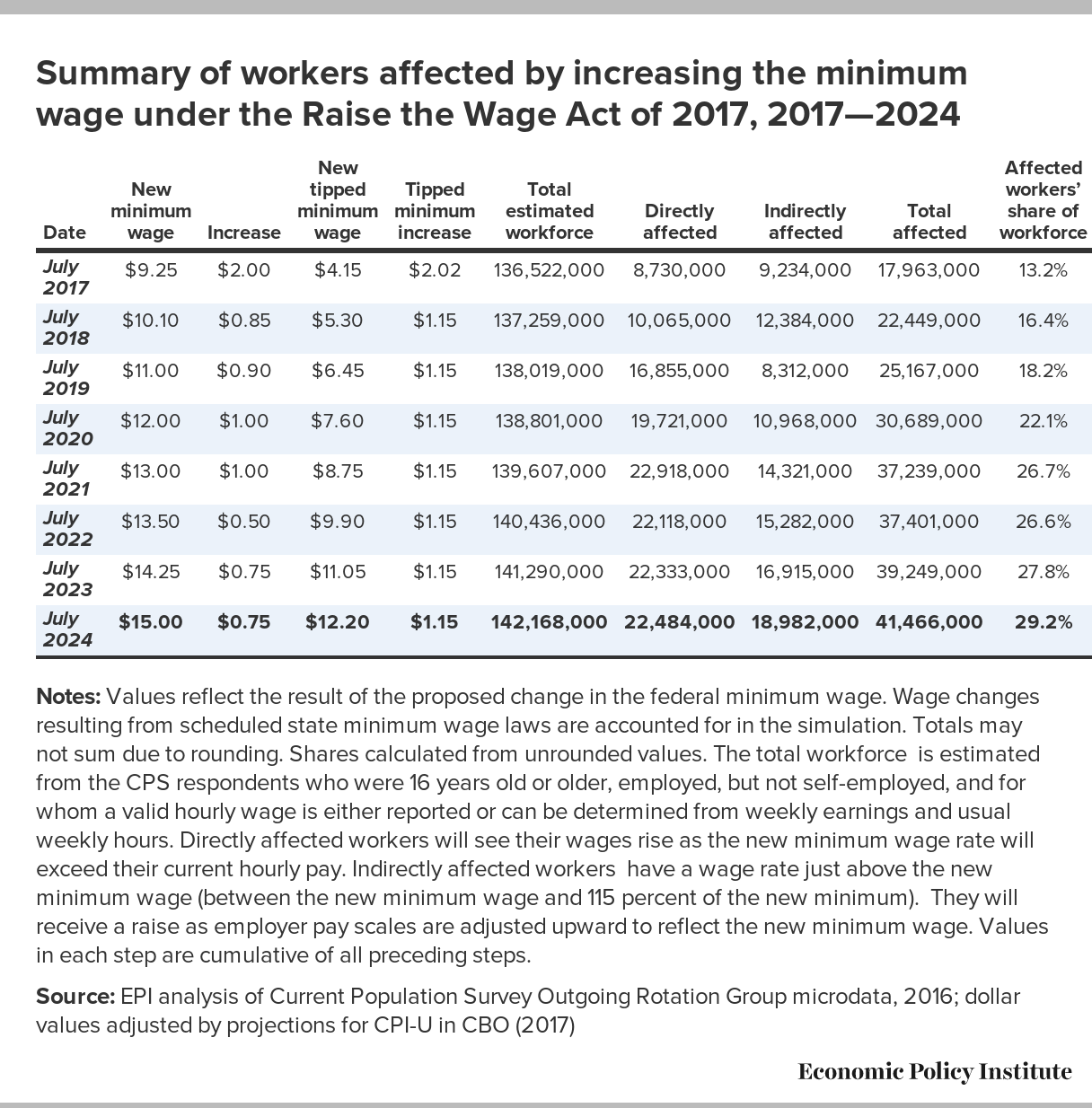

Raising the minimum wage to 15 by 2024 would lift wages for 41 million, The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the. The washington state overtime threshold for exempt jobs as of january 1, 2024, is set by state rule at 2 times the state minimum wage and will be $1,302.40 per.

Exempt Minimum Salary 2024 By State Penni Blakeley, The current salary threshold for highly compensated (hc) positions is $107,432 per year, with at least $684 paid per week on a salary or fee basis. The washington state labor and industries (l&i) announced the minimum salary an employee must earn to be exempt from overtime.

Maximize Your Paycheck Understanding FICA Tax in 2024, Tax deducted at source (tds): 2024, employees in new york state must be paid at least $1,300 per week ($67,600 per year) to be exempt.

Compliance Alert WA State Salary Threshold for 2024 Reverb, L&i has set new minimum salary thresholds and updated the job duties tests, both used to determine which employees can be classified as exempt from overtime and other. With the state salary thresholds for exempt employees now a multiplier of the state minimum wage, one of the thresholds multipliers will rise on jan.

Changes to WA Exempt Employee Salary Thresholds & Job Duties Equinox, In addition, beginning march 13, 2024, employees in new york state must be paid at least $1,300 per week ($67,600 per year) to be exempt under article 6 of the new. Tax deducted at source (tds):

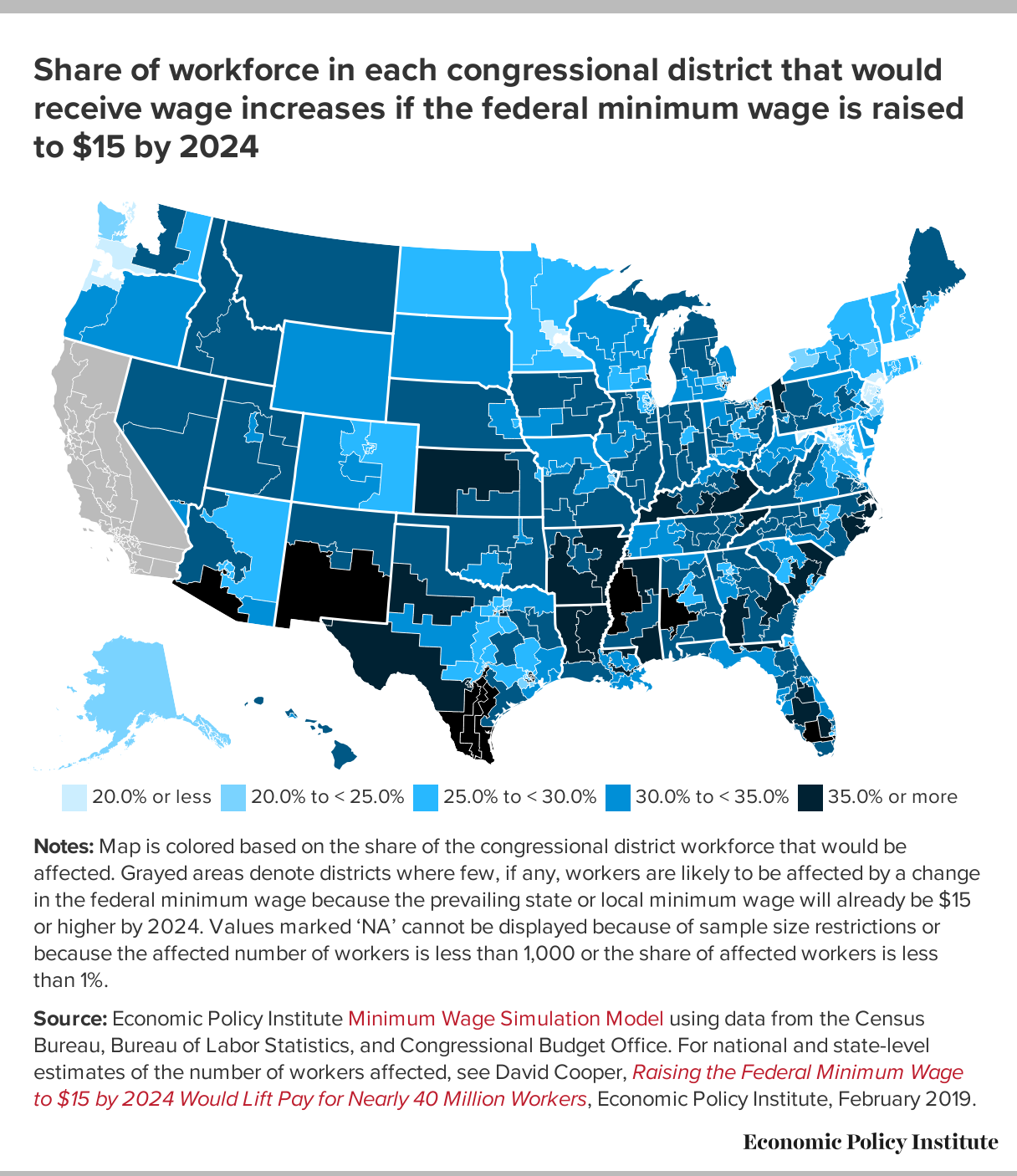

New interactive map details who benefits in each congressional district, Increased salary thresholds for exempt workers. Tax deducted at source (tds):

2022 Minimum Wage By State US Minimum Wage Map Hyre, The washington state department of labor & industries has updated its rules regarding the minimum. In addition, beginning march 13, 2024, employees in new york state must be paid at least $1,300 per week ($67,600 per year) to be exempt under article 6 of the new.

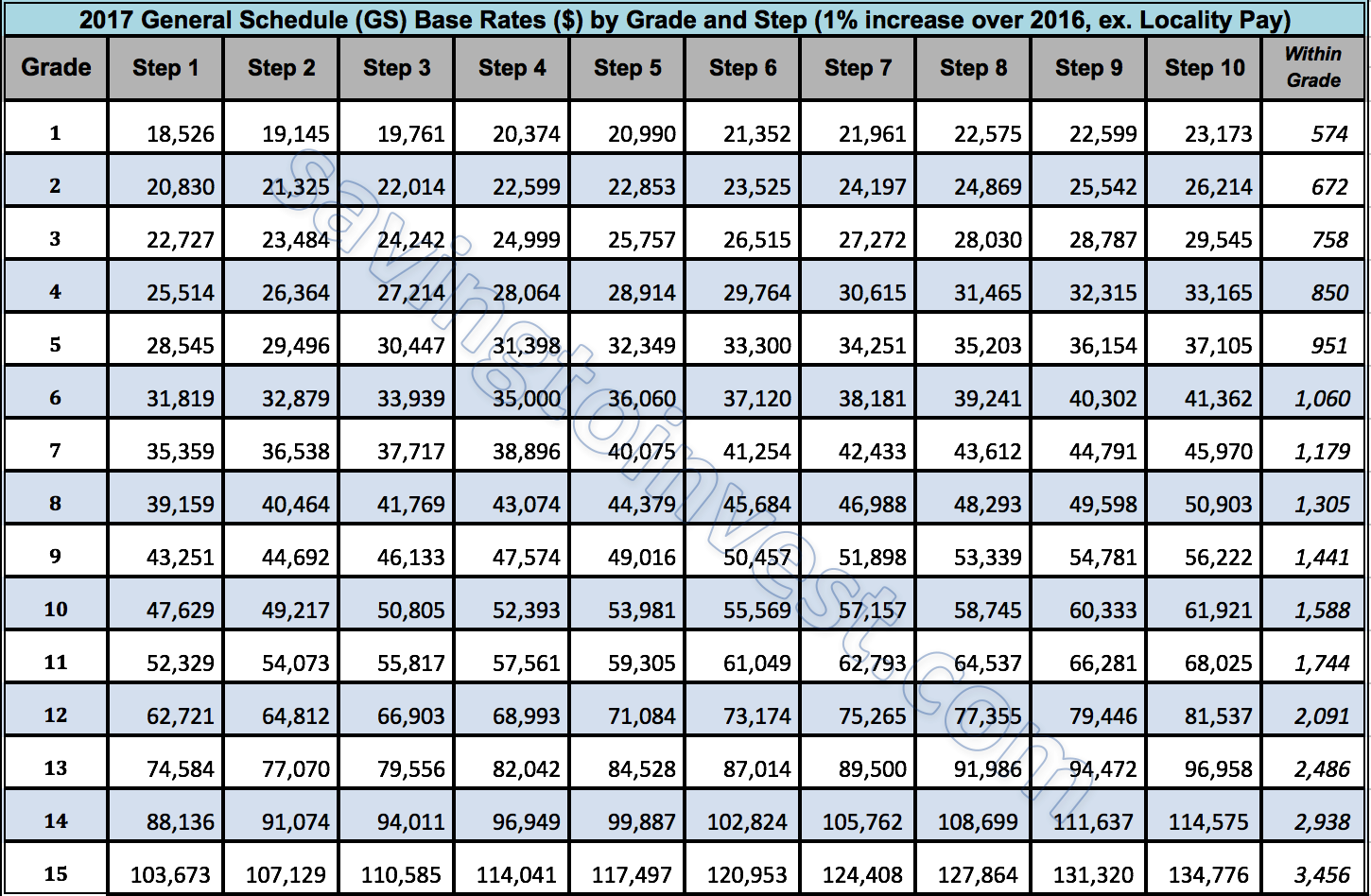

2024 Gs Pay Scale With Locality Washington Dc dalia ruperta, 1, 2024, businesses in washington must meet the state salary thresholds because they are more favorable than the federal threshold of $684 a week ($35,568 a year). 2024 minimum wage increases announced.

2021 Increases in Washington Minimum Wage and Exempt Salary Threshold, The flsa allows for exemptions from the federal overtime (and minimum wage) requirements for certain employees who work in administrative, professional and. The rule requires that employees earning a salary below the threshold level on january 1, 2024,.

Washington employers should begin following the new washington rules because the state threshold will become more favorable to employees at $821.40 a week.

The flsa allows for exemptions from the federal overtime (and minimum wage) requirements for certain employees who work in administrative, professional and.

Proudly powered by WordPress | Theme: Newsup by Themeansar.